The Inflation Reduction Act of 2022 (IRA) represents the largest-ever federal government commitment to tackling climate change and accelerating the clean energy transition. By 2030 it is expected to cut nationwide carbon emissions by 42% below 2005 levels, double the clean energy workforce to nearly 1 million, triple the amount of clean electricity on the grid to offset every home in America, and save the average citizen over $1,000 in annual energy expenditures.

As an employee-owned B Corporation, ReVision Energy is committed to helping our clients and partners – especially low-income communities hit first and worst by climate change – understand and apply the relevant provisions in the IRA, as summarized below.

As an employee-owned B Corporation, ReVision Energy is committed to helping our clients and partners – especially low-income communities hit first and worst by climate change – understand and apply the relevant provisions in the IRA, as summarized below.

Solar Investment Tax Credit

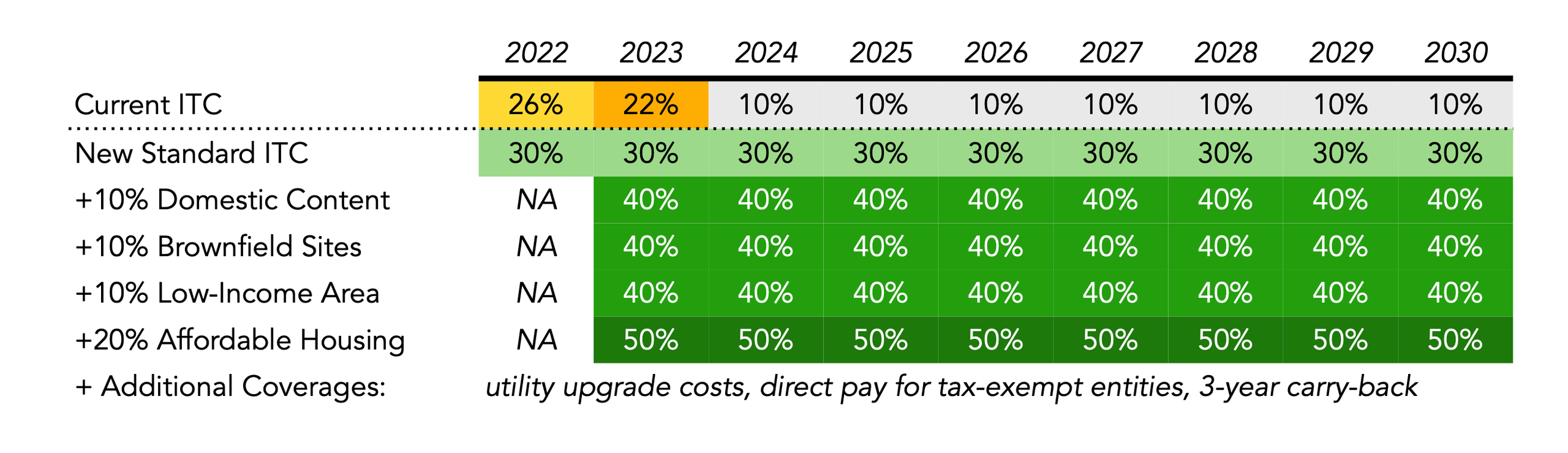

Since it was first introduced in 2006, the solar investment tax credit (ITC) has enabled taxpaying entities to reduce their federal income tax liability by up to 30% of the basis-eligible cost of a solar investment while also taking advantage of MACRS and/or Bonus depreciation.

Unlike long-term federal incentives for non-renewable energy sources, the current ITC is time-limited and scheduled to step down to 22% in 2023 and 10% thereafter for any commercial solar project. Non-taxpaying entities like schools, towns, and nonprofits have lacked access to the ITC except by indirect means of a Power Purchase Agreement (PPA), financed by taxpaying investors who seek a financial return.

Under the new IRA, the investment tax credit is effectively restored to the prior 30% effective in 2022, with the potential for stackable “bonus” ITC adders starting in 2023 worth 10 or 20 percentage points each, for a total ITC value of 40%, 50% or more in certain cases. For taxpaying entities that do not have sufficient tax liability to monetize the ITC in the first year, the ITC may now be transferred once to another taxpayer or retroactively applied to offset up to the three prior years of taxes paid by the solar project owner. A 20-year carry-forward provision still applies from the previous ITC. Non-taxpaying entities like municipalities and nonprofits may now access the ITC via a new “direct pay” provision by receiving a 100% government rebate for the ITC value in 2023 and from 2024 onwards if domestic content requirements are met (outlined below). The IRA also expands the definition of basis-eligibility when calculating ITC value to include utility upgrade costs for projects up to 5 MW (AC) starting in 2022, a major source of solar project cost inflation in recent years.

“Bonus” Investment Tax Credits

-

Domestic Content: Solar projects seeking to access the 10 percentage point bonus ITC for domestic content must procure 100% of their steel/iron from the United States along with 40% of manufactured products in 2024, 45% in 2025, 50% in 2026, and 55% in 2027 and beyond. ReVision Energy currently sources most of our steel racking systems and increasing quantities of our solar modules and associated equipment domestically.

-

Brownfield Sites: Solar arrays sited on state-designated brownfields or in newly-defined “energy communities” where coal mines or coal-fired power plants have been decommissioned since 2009 are eligible for an additional 10 point bonus ITC. Maine has 179 contaminated brownfield sites and New Hampshire has 298; Massachusetts brownfield sites remain limited by utility interconnection constraints on larger offsite projects. Coal-related infrastructure and other qualifying oil and natural gas facilities which meet the “energy community” definition are limited in New England.

Brownfield Sites: Solar arrays sited on state-designated brownfields or in newly-defined “energy communities” where coal mines or coal-fired power plants have been decommissioned since 2009 are eligible for an additional 10 point bonus ITC. Maine has 179 contaminated brownfield sites and New Hampshire has 298; Massachusetts brownfield sites remain limited by utility interconnection constraints on larger offsite projects. Coal-related infrastructure and other qualifying oil and natural gas facilities which meet the “energy community” definition are limited in New England. -

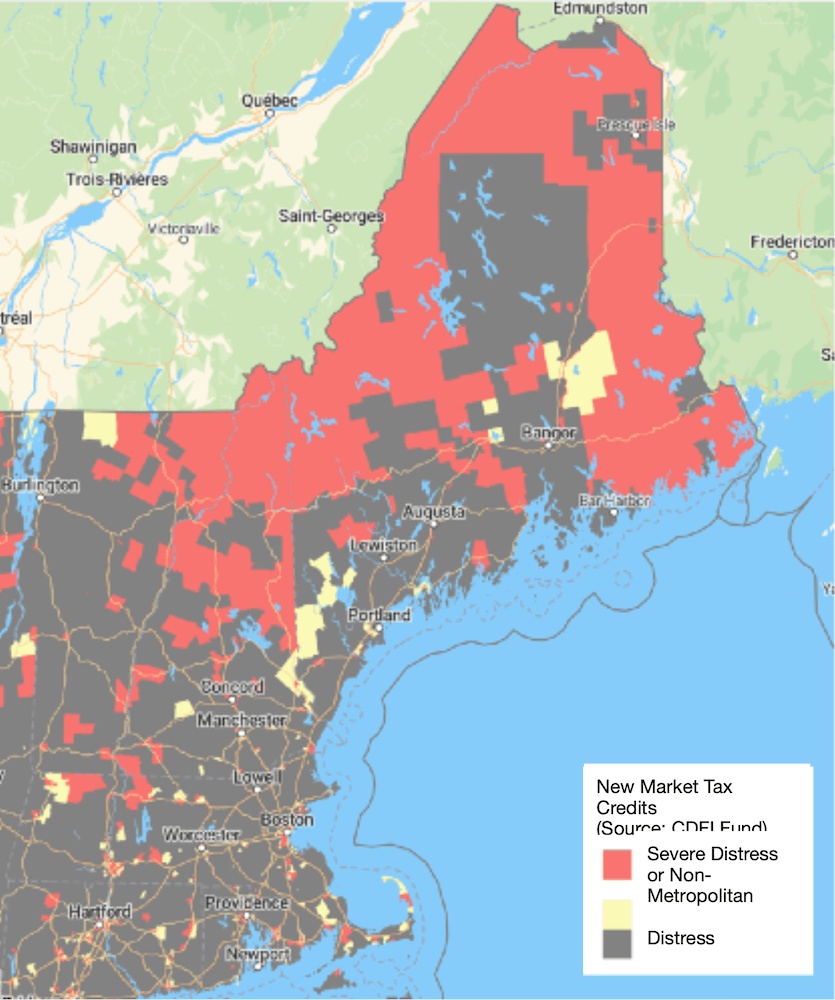

Low-Income Areas: Solar arrays located in federally-designated New Market Tax Credit (NMTC) locations with poverty rates over 20%, regardless of project type, are eligible for an additional 10 point bonus ITC. The U.S. Treasury Department will allocate such bonus credits for up to 1.8 GW of annual solar capacity starting in 2023, with unused capacity rolled forward to the next year. Projects in federally-defined “Indian land” are eligible for the same ITC adder. ReVision Energy’s New England service territory includes over 100 NMTC-designated census tracts and multiple Native American communities (marked red or yellow on the inset map).

-

Affordable Housing: Solar projects that are located on a low-income residential rental building that is part of a HUD-approved housing program, and other qualified low-income economic benefit projects, are eligible for a 20 point bonus ITC. The projects must allocate at least 50% of the financial benefits of the electricity produced (including electricity acquired at a below-market rate) to households with income of less than 200% of the poverty line or 80% of area median gross income.

Construction Labor Requirements

Large solar projects over 1 MW (AC) wishing to receive the standard 30% ITC and adders, rather than the 1/5 base rates which start at 6%, are required to meet new prevailing wage and apprenticeship requirements designed to strengthen the clean energy workforce. Prevailing wages are set locally by the Department of Labor. Apprenticeship requirements are met by making a good-faith effort to employ apprentices for 12.5% (2023) or 15% (2024 and beyond) of total project construction hours. ReVision Energy established the nation’s first in-house solar apprenticeship program in 2018 and has a long history of paying our co-owners and union subcontractors prevailing wages. ReVision will monitor U.S. Treasury guidance closely when it is released to ensure full compliance with these requirements, which go into effect 60 days after issuance of such regulations (expected in the first half of 2023).

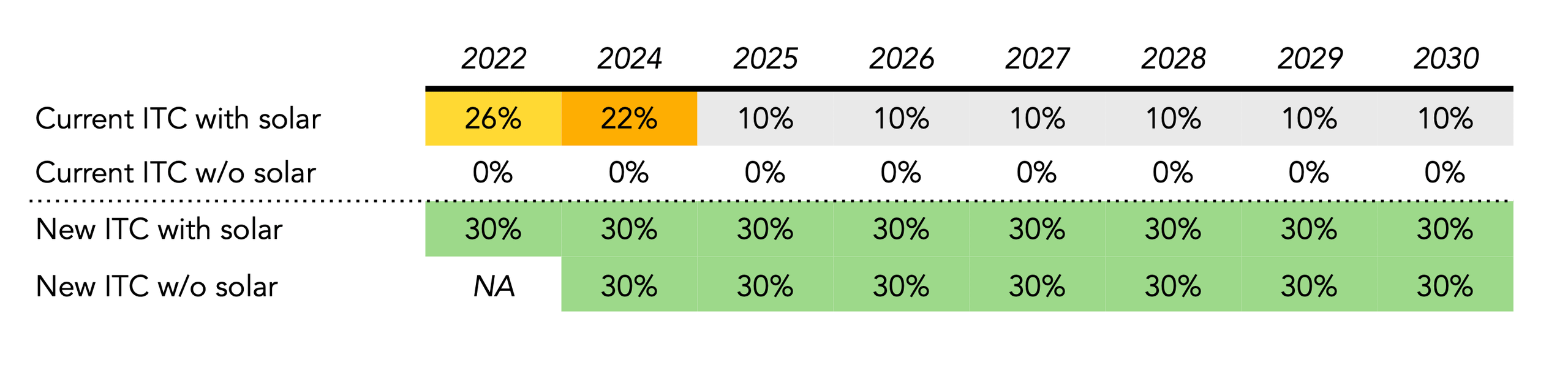

Energy Storage Investment Tax Credit

In addition to expanded solar incentives, the IRA adds standalone energy storage systems as qualifying projects under the new investment tax credit. Although most storage solutions today utilize lithium-ion battery technology, the IRA defines storage is as any property which receives, stores, and delivers energy for conversion to electricity (or, in the case of hydrogen, which stores energy) with 5 kWh or more in capacity. Storage projects with output of 1 MW (AC) or more must meet the prevailing wage and apprenticeship requirements outlined above. Standalone storage projects are not eligible for the direct pay provision outlined above.

IRA Grant/Loan Programs and EV Charging

-

Greenhouse Gas Reduction Fund (overseen by EPA): $29 billion, including $2 billion for state, local, and nonprofit programs to install zero-emission vehicle charging infrastructure

-

Climate Pollution Reduction Grants to state and local governments: $5 billion

-

Environmental and Climate Justice Block Grants: $3 billion for disadvantaged communities

-

Department of Energy Loan Program Office: $40 billion in additional loan commitment authority

-

Rural renewable energy electrification (incl. storage): $1 billion in additional loans

-

Renewable Energy for America Program (REAP) grants for rural farms/business: $1 billion in additional funding with grants up to 50% of total project cost (up from 25% today)

-

Extension, expansion, and changes to electric vehicle tax credits, including a new credit for purchasing used EVs and increased incentives for fleet electrification